As part of our commitment to innovation and security, we’re excited to introduce the new Security Bank Visa® Contactless Debit Card. This enhanced card offers a modern design, advanced security features, and the convenience of tap-to-pay technology.

Tap & Go Payments – Simply tap your card at any contactless-enabled terminal for quick and secure transactions.

Enhanced Security – Your name and card details are now printed on the back for added protection.

COMING SOON! Mobile Wallet Ready – Easily link your card to Apple Pay®, Google Pay®, or Samsung Pay® for digital payments on the go.

Same Trusted Card – Now Even Better – Continue using your card for chip and PIN or traditional swipe transactions when needed.

We are introducing contactless debit cards as your current card reaches its expiration date. Rather than a mass reissue, you will receive your upgraded card automatically in a secure, unmarked envelope when it’s time for renewal.

With the Security Bank Mobile App, you can:

Your new Security Bank Visa® Contactless Debit Card is designed to give you faster, more secure payments wherever you go. Stay tuned for your upgrade when it’s time for your renewal!

Questions? Visit your nearest Security Bank branch or contact our support team at 217-789-3500 or support@securitybk.com.

At Security Bank we feel it is important for future generations to learn healthy financial habits to instill a good foundation of financial literacy for a lifetime.

Importance of Financial Literacy

Financial literacy is crucial for everyone as it lays the foundation for a stable and successful financial future. Understanding basic financial concepts helps individuals make informed decisions about managing money, saving, investing, and avoiding debt.

Here are key reasons why financial literacy is important:

By fostering financial literacy, we empower individuals to take control of their financial futures, make prudent decisions, and build a solid foundation for their adult lives.

Budgeting and Managing Your Money

Setting up a budget is one of the best ways to manage your money. Start by listing your sources of income, such as allowance or part-time job earnings. Next, list your expenses, such as school supplies, snacks, or entertainment. Make sure your expenses do not exceed your income. Use your debit card to help you stick to your budget by tracking your spending and checking your balance regularly.

To open a youth checking or savings, contact a banker today at support@securitybk.com or 217-789-3500.

Consumers should always exercise caution when it comes to your personal and financial information. The following tips may help prevent you from becoming a fraud victim.

1. Keep Your Card Safe

Always know where your card is. Keep it in a secure place, whether in your wallet, purse, or a specific spot in your room. Do not share your PIN. Your PIN is like a password. Keep it secret, and do not share it with anyone, even friends.

2. Be Careful with Online Shopping

Use trusted websites. Only shop on websites that you know are safe. Look for "https" in the URL and a padlock symbol. Avoid public Wi-Fi when shopping online or managing your account, use a secure, private internet connection.

3. Monitor Your Account Regularly

Review your digital banking regularly for unusual transactions. Set up alerts to monitor transactions and when your card is used.

4. Report Lost or Stolen Cards Immediately

Act quickly. If you lose your card or it gets stolen, contact our Bank immediately or log in to your digital banking to report it. We can freeze your account and issue a new card. You will need to call or visit a branch to start the fraud and dispute paperwork.

5. Be Cautious with Card Sharing

Avoid lending your card to friends or family.

6. Secure Your Devices

Protect your phone and computer with strong, unique passwords. Utilize multi-factor authentication when available for extra security. Look for card skimmers before inserting or swiping a card at any point of sale – this includes gas stations and ATMs.

Please contact a member of our retail team to learn how you can safely use your debit card and digital banking.

In a recent scam, cybercriminals posted a fake video of Elon Musk on YouTube, trying to trick you into handing over your money. Cybercriminals often use AI to impersonate celebrities so that they can spread misinformation or trick people into falling for their scams. This particular scam attempts to trick you into depositing your cryptocurrency into an online account.

In this scam, the cybercriminals used AI to create a fake video that looks and sounds like the real Elon Musk. The video contains a QR code, and the AI-generated Musk urges you to scan it. If you follow the instructions to scan the code, you will be directed to deposit money into an account with the promise of receiving a larger return for your investment. The catch is there is no return on your investment. Your funds are deposited right into the scammers’ pockets!

Follow these tips to avoid falling victim to an AI video scam:

* Be wary of any social media content that uses endorsements from celebrities, because celebrities can be impersonated online.

* Be cautious whenever you are prompted to enter financial information online. Only use official financial websites.

* No legitimate financial institution will guarantee a large return on a small investment. If the opportunity seems too good to be true, it usually is.

Avoid Phishing Scams with Three Simple Tips Phishing scams are online messages designed to look like they’re from a trusted source. We may open what we thought was a safe email, attachment, or image only to find ourselves exposed to malware or a scammer looking for our personal data. The good news is we can take precautions to protect our important data. Learn to recognize the signs and report phishing to protect devices and data.

* Urgent or emotionally appealing language

* Requests to send personal or financial information

* Unexpected attachments

* Untrusted shortened URLs

* Email addresses that do not match the supposed sender

* Poor writing/misspellings (less common)

Report suspicious messages by using the “report spam” feature. If the message is designed to resemble an organization you trust, report the message by alerting the organization using their contact information found on their webpage.

Delete the message. Don’t reply or click on any attachment or link, including any “unsubscribe” link. The unsubscribe button could also carry a link used for phishing. Just delete.

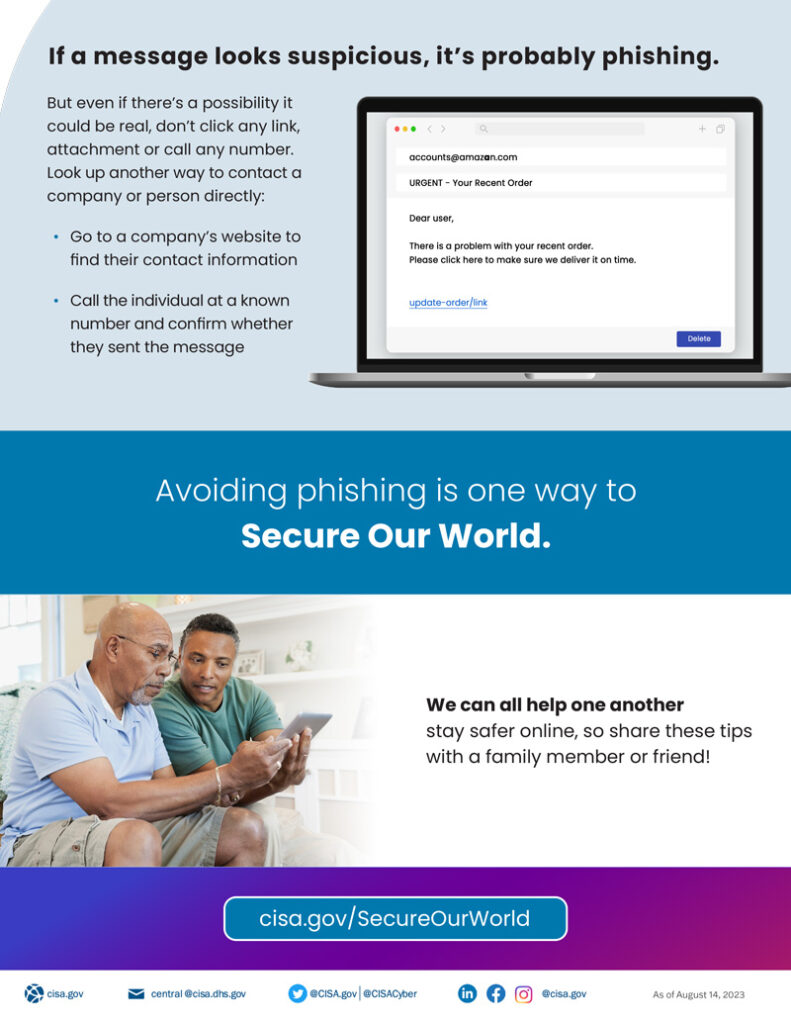

If a message looks suspicious, it’s probably phishing.

But even if there’s a possibility it could be real, don’t click any link or attachment or call any number. Look up another way to contact a company or person directly:

* Go to a company’s website to find their contact information

* Call the individual at a known number and confirm whether they sent the message

Avoiding phishing is one way to Secure Our World. We can help one another stay safer online so share these tips with a family member or friend!

Information provided by Secure Our world via cisa.gov/SecureOurWorld